Last updated on

Discover the essential steps to acquiring a new roof without paying a deductible, as we guide you through navigating insurance claims and finding alternative financing options for your home improvement project.

Are you tired of paying hefty deductibles when it’s time to replace your old, worn-out roof? A new roof is a significant investment that can cost thousands of dollars, and the last thing you want is to pay even more out-of-pocket expenses. But what if there was a way to get a new roof without paying any deductible? Yes, it’s possible! In this article, we’ll share some tips and tricks on how to get a new roof without paying any deductible.

So sit tight and read on to find out how you can save money while still getting the best roofing solution for your home.

Understanding Insurance Deductibles

When it comes to insurance, a deductible is the amount of money you pay out-of-pocket before your insurance coverage kicks in. In most cases, homeowners have a set deductible for their home insurance policy that applies to all claims.

This means that if you file an insurance claim for roof damage and your deductible is $1,000, then you will be responsible for paying the first $1,000 of repair or replacement costs.

It’s important to understand how deductibles work because they can significantly impact the cost of repairing or replacing your roof. If your roofing project exceeds the amount of your deductible and falls under covered damages by homeowner’s policy terms and conditions; then only will an insurer cover any additional expenses beyond this threshold.

In some cases where there are multiple types of damage caused by different events (e.g., hailstorm followed by heavy rain), each event may have its own separate deductible which could increase overall costs even further.

Understanding Roof Replacement Deductibles

A deductible is the amount of money you pay out-of-pocket before your insurance company covers the remaining cost of repairs or replacement. The amount of your deductible can vary depending on several factors, including where you live and what type of policy you have.

Roof replacement deductibles are typically a percentage-based on the total value insured for a home’s structure rather than being a fixed dollar amount. For example, if your home has an insured value worth $300,000 and has a 2% roof damage coverage deductible rate in place; then any claim made will require that 2% ($6k) be paid by homeowners before their insurer pays anything towards repair or replace costs.

It’s essential to understand how much you’ll need to pay out-of-pocket when filing an insurance claim for roof damage so that there are no surprises down the line.

Homeowners Insurance and Roof Damage Coverage

When it comes to roof damage, most homeowners’ policies cover damages resulting from natural disasters such as hailstorms, windstorms, and fire. However, the extent of coverage may vary depending on the type of policy you have.

It’s essential to review your policy carefully and understand what is covered before filing a claim for roof damage. Some policies may only cover repairs rather than full replacement costs or limit coverage based on age or condition of the roof.

Some insurance companies require regular maintenance checks as part of their policy requirements; failure to comply with these requirements could result in denied claims.

Actual Cash Value Vs. Replacement Cost Value Policies

ACV is the cost to replace your roof minus depreciation, while RCV covers the full cost of replacing your roof with a new one.

It’s important to understand which type of policy you have before filing an insurance claim for a new roof. If you have an ACV policy, then expect that your payout will be less than what it would take to replace your entire roofing system.

On the other hand, if you have an RCV policy and file a claim for storm damage or any other covered peril that requires replacement rather than repair work on part or all of the damaged area(s), then expect reimbursement up-to-policy limits.

While RCV policies may seem like they offer better protection against unexpected expenses in case something happens with our roofs; they often come at higher premiums compared with ACVs because insurers assume more risk by covering full replacement costs without factoring in depreciation.

Assessing Roof Damage

Before you file an insurance claim or start looking for financing options, it’s essential to determine the extent of your roof damage. Inspect your roof thoroughly and look out for signs such as missing shingles, cracks, leaks, and water stains on ceilings or walls.

If you’re not sure how to assess your roofing system’s condition accurately, consider hiring a professional roofing contractor who can provide an expert opinion on whether repair or replacement is necessary.

It’s important to note that some types of damages may not be covered by insurance policies. For instance, if the damage was caused by lack of maintenance rather than natural disasters like hailstorms or hurricanes.

Therefore it’s crucial that homeowners understand their policy coverage before filing claims with their insurer.

Repair Vs. Replace: Making the Right Decision

While repairs may seem like a more cost-effective solution in the short term, they may not always be the best option in terms of long-term value and durability.

In some cases, repairing minor damages such as leaks or missing shingles can extend your roof’s lifespan for a few years. However, if your roof is old and has significant damage that affects its structural integrity or poses safety risks to you and your family members, replacing it might be necessary.

To make an informed decision on whether to repair or replace your damaged roof, consider factors such as age of the current roofing system; extent of damage; frequency and severity of previous repairs; energy efficiency concerns; local building codes requirements among others.

It’s important also that you consult with a professional roofing contractor who will assess the condition of your existing roofing system before recommending any course action.

Roof Inspection Importance

A professional inspection will help identify any potential issues with your current roofing system and determine if repairs or replacement are necessary. Regular inspections can also help extend the lifespan of your roof and prevent costly damages that may not be covered by insurance.

It’s recommended to have a professional inspect your roof at least once every year, especially after severe weather events such as hailstorms or hurricanes. During an inspection, a roofing contractor will check for signs of wear and tear on shingles, flashing around chimneys or vents, gutters clogged with debris that could cause water damage inside the home.

By identifying problems early on through regular inspections before they become major issues requiring full replacements; homeowners can save money in repair costs over time while ensuring their homes remain safe from leaks caused by damaged roofs.

Storm Damage and Claims

If you suspect that your roof has been damaged by a storm, the first step is always safety. Do not attempt any repairs or climb onto your roof until you have assessed the situation and determined that it is safe.

Once you’ve ensured everyone’s safety, assess the extent of damage caused by hailstones or strong winds on your roofing system. Take photos of all visible damages as evidence for insurance claims purposes.

If there are leaks in your home after a storm, try to contain them with buckets or tarps while waiting for professional help from an experienced roofing contractor who will provide temporary solutions before permanent repairs are made.

Comparing Insurance Estimates With Roofing Contractor Estimates

You can obtain estimates from both your insurance company and a roofing contractor. It’s essential to compare these estimates carefully before making any decisions.

Insurance companies will typically send out their own adjuster who will assess the damage and provide an estimate based on their calculations. This estimate may not always cover all necessary repairs or replacements, so it’s crucial that you review it thoroughly with your roofing contractor.

Roofing contractors are experts in this field and can provide more accurate assessments of what needs repairing or replacing than insurance adjusters who may not have as much experience in this area. They also know how much materials cost, which is important when comparing quotes between different contractors.

When comparing estimates from both parties, make sure they include all necessary work required for repair or replacement of your roof – including labor costs – so that there are no surprises later on down the line. Ensure that each quote includes details about warranties offered by manufacturers and installers alike.

How to Negotiate a Full Roof Replacement With Insurance

In this case, it’s essential to negotiate with your insurance adjuster to ensure that you get adequate compensation for your roofing needs.

To start negotiating, gather estimates from reputable roofing contractors in your area. These estimates should include all necessary repairs or replacements required for a fully functional roof.

Once you have these quotes in hand, compare them with the estimate provided by your insurance company.

If there is any discrepancy between what was estimated and what is needed to repair or replace the damaged roof properly, bring it up during negotiations. Be sure to provide evidence such as photos or videos showing why additional work is necessary.

It’s also important to be persistent but polite when negotiating with an adjuster; remember that they are just doing their job and want to keep costs low for their employer (the insurer).

Choosing a Roofing Contractor

You want to ensure that you hire someone who is experienced, reliable, and trustworthy. Start by asking for recommendations from friends and family members who have recently had their roofs replaced.

Check online reviews and ratings of local contractors to get an idea of their reputation.

Once you’ve narrowed down your list of potential contractors, ask for references from previous clients they have worked with before. A reputable contractor will be happy to provide this information as it shows they are confident in the quality of their work.

When meeting with potential contractors, make sure they are licensed and insured. Ask about warranties on materials used as well as labor guarantees offered by the company.

Don’t base your decision solely on price; while cost is important when choosing a roofing contractor, it should not be the only factor considered when making your final choice.

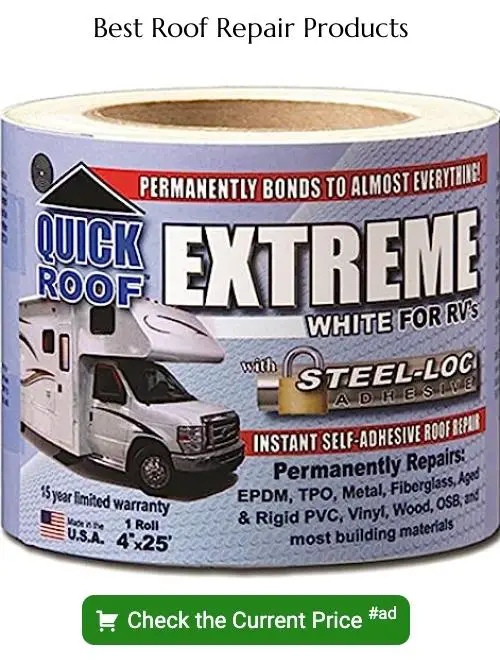

Obtaining a Free Roof Replacement Quote

A roofing contractor will assess your roof’s condition and provide you with an estimate of how much it would cost to replace or repair your roof. It’s important to get multiple quotes from different contractors so that you can compare prices and services offered.

To obtain a free quote, start by researching reputable roofing companies in your area. Look for reviews online or ask friends and family for recommendations.

Once you have narrowed down potential contractors, contact them via phone or email to schedule an appointment.

During the appointment, the contractor will inspect your current roof and take measurements before providing you with a detailed estimate of costs involved in replacing it entirely or repairing any damages found during inspection.

It’s crucial that when requesting quotes from various contractors; ensure they are all quoting on similar materials as this makes comparing their estimates easier while also ensuring accuracy across all bids received.

Alternative Roofing Materials

While traditional asphalt shingles are the most common choice for residential roofs, there are other options that can be more cost-effective and environmentally friendly.

Metal roofing is becoming increasingly popular due to its durability and energy efficiency. It’s also available in a variety of styles and colors that can complement any home design.

Another option is synthetic slate or shake tiles made from recycled rubber or plastic. They offer the same aesthetic appeal as natural slate or wood shakes but at a fraction of the cost.

Green roofs have also gained popularity in recent years as an eco-friendly option that provides insulation benefits while reducing stormwater runoff. These roofs feature vegetation planted over layers of soil on top of waterproof membranes.

Factors Affecting Roof Replacement Costs

The size of your home and the type of roofing material you choose are two significant factors that affect the overall cost. Other variables include labor costs, permits, disposal fees for old materials, and any necessary repairs or upgrades to underlying structures.

The complexity of your roof’s design also plays a role in determining replacement costs. A simple gable-style roof will be less expensive than a complex hip or mansard style with multiple angles and slopes.

If there is damage beyond just needing a new roof such as water damage or structural issues that need repair before installation can begin this will add additional expenses.

It’s essential to consider all these factors when budgeting for a new roof so you can make an informed decision about what type of roofing solution best fits both your needs and budget constraints.

Timing Your Roof Replacement

The best time for a roof replacement depends on several factors, including the weather conditions in your area and the age of your current roof. If you’re planning to replace your old, worn-out roof without paying any deductible, timing is crucial.

The ideal time for a new roofing installation is during mild weather conditions such as spring or fall when temperatures are moderate and there’s less chance of rain or snowfall. This will ensure that the roofing materials can be installed correctly without being affected by extreme heat or cold.

It’s also important to consider how long you’ve had your current roof before deciding on a replacement timeline. Most roofs have an average lifespan of 20-25 years depending on their quality and maintenance level; if yours has reached this point, it may be time for an upgrade.

However, if you notice signs of damage like leaks or missing shingles before reaching this timeframe limit – don’t wait! These issues can quickly escalate into more significant problems that could cost even more money down the line.

Financial Assistance Programs

These programs provide funding or low-interest loans to homeowners who need assistance with home repairs and improvements. Some of the most popular financial assistance programs include government grants, community development block grants, and energy-efficient mortgages.

Government grants are typically offered by federal or state agencies and can be used for various home improvement projects, including roof replacement. Community development block grants are provided by local governments to support community revitalization efforts that may include housing rehabilitation projects.

Energy-efficient mortgages allow homeowners to finance energy-saving upgrades like a new roof through their mortgage loan without increasing their monthly payments significantly.

Before applying for any financial assistance program, it’s essential first to research eligibility requirements thoroughly. You’ll also want to compare interest rates and repayment terms from different lenders before making your final decision on which program is right for you.

Options for Financing Roof Replacement Deductibles

One option is to take out a personal loan from a bank or credit union. Personal loans typically have lower interest rates than credit cards and can be paid back over time with fixed monthly payments.

Another option is to use a home equity line of credit (HELOC). A HELOC allows you to borrow against the equity in your home and use it for any purpose, including roof replacement deductibles.

However, keep in mind that using this type of financing puts your home at risk if you’re unable to make payments.

Some roofing contractors offer financing options as well. These may include payment plans or lines of credit specifically designed for roofing projects.

Lastly, some states offer assistance programs for low-income homeowners who need help paying their insurance deductibles or repairing their roofs after natural disasters like hurricanes or tornadoes.

Government Grants for Roofs

The federal government offers various grant programs that provide financial assistance to homeowners who need help with home repairs and improvements, including roof replacement.

One such program is the USDA Rural Development Program. This program provides grants and loans to low-income homeowners in rural areas who need assistance with home repairs or modifications.

If you meet the income requirements and live in a qualifying area, you may be eligible for up to $7,500 in grant funds.

Another option is the HUD Community Development Block Grant (CDBG) Program. This program provides funding to local governments and non-profit organizations that offer housing rehabilitation services for low- or moderate-income households.

These services can include roofing repair or replacement.

It’s important to note that these programs have specific eligibility requirements based on income level, location of residence, type of property ownership (single-family homes versus multi-unit buildings), among other factors. Therefore it’s essential first check if one qualifies before applying as there are limited funds available each year.

Risks and Consequences of Waived Deductibles

Insurance companies consider waiving deductibles as fraudulent activity and could result in legal action against you or the roofing contractor. If an adjuster discovers that a deductible was waived during their inspection of the property, they may deny coverage for any future claims related to the same damage.

Moreover, some contractors who offer to waive deductibles are likely cutting corners on materials or installation quality which could lead to subpar workmanship and potential leaks down the line. It’s essential always to choose a reputable roofing contractor with proper licensing and insurance coverage.

While waiving your roof replacement deductible might seem like an easy way out of paying upfront costs; it is not worth risking legal repercussions or shoddy workmanship from unscrupulous contractors.

Preventative Roof Maintenance

Regular inspections can help identify potential issues before they become major problems, such as leaks or structural damage. It’s recommended to have a professional roofing contractor inspect your roof at least once a year, especially after severe weather conditions like hailstorms or heavy snowfall.

In addition to regular inspections, there are several preventative measures you can take to maintain the integrity of your roof. Keeping gutters clean and free from debris will prevent water buildup that could lead to leaks and other damages.

Trimming overhanging tree branches will also reduce the risk of falling limbs damaging the shingles.

Another important factor in preventative maintenance is ensuring proper ventilation in your attic space. Poor ventilation can cause moisture buildup that leads to mold growth and rotting wood structures within the roofing system.

By taking these simple steps towards preventative maintenance for your home’s roofing system, you’ll be able not only save money on costly repairs but also extend its lifespan significantly while maintaining its aesthetic appeal for years ahead!

FAQ

How can I avoid paying my home insurance deductible?

To avoid paying your home insurance deductible, only file claims when absolutely necessary, as excessive claims can classify you as a "high-risk" homeowner and lead to increased premiums.

Is it illegal in Texas for a roofer to pay your deductible?

Yes, it is illegal in Texas for a roofer to pay your deductible as they cannot waive, discount, or offer a "free" roof.

How many shingles need to be missing for insurance?

One missing shingle is enough for insurance to replace all shingles if the original shingle type has been discontinued.

What does it mean to absorb the deductible?

Absorbing the deductible means that the insurance company pays the policy limit when it is less than the total loss minus the deductible, effectively covering the deductible amount in such a scenario.

What are the consequences of not paying a deductible when getting a new roof?

Failing to pay a deductible when getting a new roof may result in a voided insurance claim, additional costs, and potential legal issues.

Are there any specific regulations regarding deductible payment for roof replacements in other states?

Deductible payment regulations for roof replacements vary across states, making it essential to check the specific laws and guidelines in your area.

Can I negotiate with my insurance company to lower the deductible for my roof replacement?

Yes, you can negotiate with your insurance company to lower the deductible for your roof replacement, as it may be possible to discuss and adjust based on your specific circumstances and policy.