Last updated on

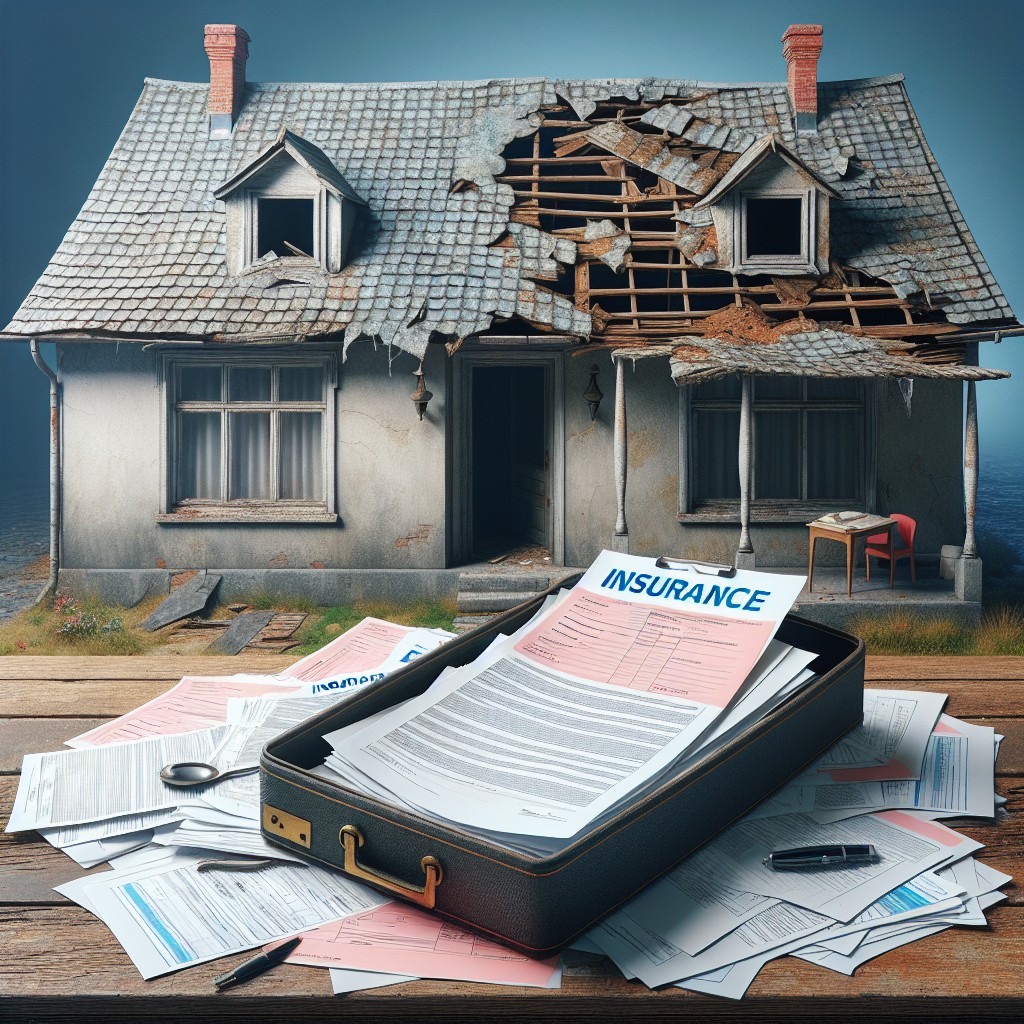

Choosing not to use your insurance money to repair your roof could risk further damage, jeopardize your coverage, and potentially decrease your property’s value.

Key takeaways:

- Failing to use insurance money can result in further damage.

- Understand your insurance coverage and policy specifics.

- Not using insurance funds can decrease your property’s value.

- Neglecting repairs may lead to insurance coverage loss.

- Violating mortgage terms can have serious consequences.

Understanding Insurance Claims

Navigating the intricacies of insurance claims is crucial to making informed decisions about your property. Initially, it’s imperative to discern the difference between a replacement cost value policy and an actual cash value policy, as this determines reimbursement levels post-damage.

Understanding your policy’s deductible is also essential; this is the out-of-pocket amount you’re responsible for before your insurance coverage kicks in.

Promptly filing a claim after roof damage ensures you meet your insurance company’s deadlines, which is vital to preserve your right to compensation. Keep comprehensive documentation of the damage, including photos and detailed notes— these will support your claim and facilitate a smoother claims process.

Finally, know that the insurance payout is meant to restore your roof to its pre-damage condition, not to act as a financial windfall. Utilizing the funds accordingly helps maintain the integrity of your home and your insurance agreement.

Know What Type of Insurance Coverage You Have

Insurance policies often differ in coverage specifics. It’s essential to scrutinize your policy to understand the scope of what’s covered regarding roof damage. Typically, homeowners insurance covers roof damage from unpreventable events such as fires, vandalism, and certain natural disasters. Conversely, damage resulting from wear and tear or poor maintenance may not be covered.

Identify whether you have Replacement Cost Value (RCV) or Actual Cash Value (ACV) coverage. RCV policies reimburse the full cost to repair or replace the damaged section of your roof, minus your deductible. ACV coverage considers the roof’s age and condition at the time of damage, providing a depreciated reimbursement.

Examine your policy for any specific endorsements that add or restrict coverage. Some policies include endorsements for extended replacement costs, which can offer additional protection if the repair costs exceed your policy limits.

Acknowledging your deductible amount is also crucial, as it represents the out-of-pocket expense you must pay before the insurance coverage kicks in.

Lastly, understand the claim process, including any time limits for filing and completing roof repairs. Delaying repairs could impact future claims or result in denial of a claim for the existing damage.

Consequences of Not Using Insurance Money to Fix Roof

Failing to repair your roof with the funds from an insurance claim can have several repercussions. Firstly, your property value may suffer. A well-maintained roof is crucial for the marketability of your home, and any signs of neglect can significantly lower its worth.

In addition, if the existing damage is not addressed promptly, it can lead to further deterioration. This might manifest as leaks that can cause interior water damage, mold growth, or structural issues over time. Such secondary damages might not be covered by future insurance claims, as they can be seen as a result of homeowner negligence.

Moreover, your insurance policy may include a requirement to perform necessary repairs. Ignoring this could lead to a breach of policy conditions, leading your insurer to deny future claims or even cancel your coverage altogether.

If you have a mortgage on your property, it’s also likely that your mortgage agreement requires you to keep the home in good repair. Failing to adhere to this agreement by not using insurance money for repairs could violate the terms of your loan.

Lastly, some jurisdictions may have legal stipulations regarding the utilization of insurance payouts. Noncompliance in these cases could have legal consequences.

Making an informed decision about your roof repair involves considering these factors to ensure the long-term protection and value of your home.

Decreased Property Value

Failing to repair your roof after receiving an insurance payout can significantly impact your home’s marketability. When a roof remains damaged:

- Curbside Appeal Suffers: Prospective buyers often judge a home by its exterior. A damaged roof is a visible deterrent.

- Home Inspections Flag Issues: Inspectors are keen on spotting roof problems, which can derail negotiations or lower offers.

- Property Assessments Reflect Disrepair: Homes with unrepaired damage often receive lower valuations on assessments, affecting resale value.

- Higher Cost for Future Repairs: Over time, small problems can evolve into more extensive damage, increasing the cost of eventual repairs.

- Reduced Buyer Interest: Knowledge of prior claims not addressed may lead to potential buyers withdrawing interest to avoid inheriting unresolved problems.

By not using insurance funds to make necessary roof repairs, homeowners risk diminishing their property’s value and appeal in the competitive real estate market.

Potential Roof Worsening and Secondary Damage

Neglecting to address roof repairs after an insurance claim can lead to a host of problems. Without timely intervention, an initially small issue can escalate, causing the roof structure to deteriorate. This decline compromises the roof’s ability to protect your home from the elements, potentially resulting in water intrusion that leads to mold, rot, or structural damage.

Furthermore, a damaged roof may no longer meet building codes or manufacturer’s warranty requirements. Should you choose to sell your property, buyers might be deterred by the compromised state of the roof, insisting on additional repairs or price adjustments.

Additionally, the weakened roof may become less energy efficient. Cracks and openings can lead to increased heating and cooling costs as they allow air to escape.

Lastly, consider the impact of seasonal weather conditions. In areas prone to heavy snowfall or high winds, an already weakened roof is at a greater risk of catastrophic failure, which endangers both inhabitants and property.

To safeguard your home and finances, it is critical to use your insurance payout for intended repairs, thereby preventing the situation from escalating into costlier and potentially hazardous scenarios.

Loss of Insurance Coverage

If you choose not to repair the roof with the insurance payout, your insurer may see this as neglecting the maintenance of your home. This can lead to several issues:

- Future Claims Denial: Your insurance company might refuse to cover any subsequent damage related to or exacerbated by the existing roof damage.

- Premium Increases: Insurers could classify your home as a higher risk, resulting in increased premiums.

- Policy Cancellation: In extreme cases, an insurance company may cancel your policy for failing to carry out necessary repairs, leaving you unprotected against potential losses.

- Difficulty Obtaining New Insurance: Without a well-maintained roof, finding a new insurer willing to cover your home could become challenging.

Manage your roof repairs responsibly to ensure continued insurance coverage and protect your home’s integrity.

Violation of Mortgage Company Terms

Mortgage agreements often stipulate that homeowners must maintain their property in good condition. When an insurance claim is made for roof damage, the lender expects the settlement to be used for repairs, protecting their investment. Ignoring this obligation can put homeowners at risk of violating their mortgage terms.

Repair requirements: Lenders may require proof that insurance payouts are used for designated repairs within a certain time frame.

Risk of default: Not adhering to repair clauses can be considered a default on the mortgage agreement.

Lender intervention: Mortgage companies can place insurance proceeds in escrow, releasing funds only for verified repairs.

Forced coverage: If repairs are not made, lenders may initiate “force-placed” insurance, which is often more expensive and provides less coverage.

Understanding these potential repercussions is crucial when deciding how to use insurance money following a roof damage claim.

Legal Implications of Not Using Insurance Money

When the insurance payout is earmarked for roof repair, it’s essential to understand that diverting funds can have legal repercussions. First, the insurance contract may stipulate that the funds must be used as intended or returned. Misappropriation of these funds could be considered insurance fraud, with serious penalties, including fines or prosecution.

Furthermore, if your roof damage results from a natural disaster and you’ve received government assistance or grants, using that money for purposes other than specified might violate federal regulations, leading to a demand for repayment or even criminal charges. Always consult legal counsel or a financial advisor before making decisions about insurance payouts to avoid inadvertent legal violations.

Options for Using Insurance Money

When your insurance company issues a payout for roof damage, you have several paths to consider:

1. Complete Repair: Hiring a professional roofing contractor to repair the damage in accordance with the insurance estimate ensures your roof is restored to its pre-damage condition.

2. Upgrade: Use the opportunity to invest additional personal funds and upgrade to higher-quality materials, which may extend the lifespan of your roof and improve your home’s resilience to future damage.

3. DIY Repairs: If the damage is minor and you possess the necessary skills, performing the repairs yourself could save on labor costs. However, this may impact future insurance claims and warranties.

4. Bank the Funds: Setting the money aside for future maintenance or repairs might be tempting, but this approach could complicate issues with your insurance provider and may violate the terms of your policy or mortgage agreement.

Each choice carries implications for the future of your roof, home value, and insurance coverage, so weigh these options carefully, considering both immediate needs and long-term consequences.

Considerations Before Deciding Not to Fix the Roof

Assessing the Damage: Evaluate the extent of the roof damage. Minor issues may not require immediate attention, but significant damage should not be ignored.

Future Financial Planning: Budget for potential increased costs down the line. Unaddressed damage can lead to more expensive repairs or complete roof replacement.

Insurance Policy Review: Read your policy carefully. Some policies have stipulations regarding the timeline for repairs after a claim, which could affect future claims.

Safety Concerns: Consider the safety implications for your household. A damaged roof may compromise the structural integrity of your home.

Market Value Consideration: Think about your home’s resale value. A damaged roof could deter potential buyers or lower the selling price.

Alternative Use of Funds: If considering using the insurance money for other expenses, weigh this against the risk of uncovered future roof-related damage.

Professional Consultation: Seek advice from a roofing professional or an insurance claim specialist to understand the implications of delaying roof repair.

FAQ

Why does the roofer get the depreciation check?

The roofer receives the depreciation check as payment for the remainder of the cost associated with the completed roof replacement.

Does mortgage company keep leftover insurance money?

In California, the mortgage company generally assigns the rights to insurance proceeds up to the amount of the outstanding loan balance, which implies that any leftover insurance money may not necessarily be kept by the mortgage company.

What makes a roof uninsurable?

A roof may be deemed uninsurable due to its age, typically beyond 20-30 years, or if it has suffered significant damage or neglect due to poor maintenance.

Is a leaking roof covered by insurance UK?

In the UK, home insurance policies generally cover roof leaks if caused by a sudden, unexpected event, but do not cover repairs if the damage is due to wear and tear.

Can homeowners insurance deny roof claims?

Yes, homeowners insurance can deny roof claims, predominantly if the damage is attributed to neglect, intentional actions, normal wear and tear, or if the roof exceeded its lifespan.

How is the insurance payout determined for roof damage?

The insurance payout for roof damage is generally determined by the roof’s age, condition prior to damage, policy details, and cost of repair or replacement, subject to the adjustment process and depreciation.

What types of roof damages are typically covered by U.S. insurance policies?

U.S. insurance policies typically cover roof damages caused by perils like fire, hail, wind, and other unexpected events considered beyond the homeowner’s control.